To be an accredited investor, a person must meet one of the following classifications: An individual with an annual income exceeding $200,000 ($300,000 for joint income) for the last two years and with the expectation of earning the same or a higher amount in the current year; or an individual with a net worth exceeding $1 million, either individually or jointly with their spouse, not including their primary residence; or an entity is considered an accredited investor if it is a private business development company or an organization with assets exceeding $5 million.

Accredited investors are expected to complete their own due diligence which often means reviewing the information offered by the fund managers or the accredited investor’s financial advisor.

Ideally, accredited investor opportunities are greater than the everyday mutual funds where most non-accredited investors build their wealth. Venture capital firms, hedge funds and private equity firms aim to procure strong investment opportunities for accredited investors that can outperform general index funds.

Minimum Investment

A larger minimum investment is often required for accredited investor opportunities but if combined with the right investment strategy, returns can be far better and more consistent than non-accredited investor options.

Accredited investor opportunities will often require a $100,000 minimum investment and an incentive to invest up to 7 figures. Many hedge funds have a minimum investment of $500,000, the highest demand funds are invite-only.

Where to Find Lower Minimum Investments

Real estate syndications have been known to have minimum investment amounts of $25,000 to $30,000 which may be a better fit for someone trying to diversify into real estate even if they are accredited. Often accredited investors can’t quit their day job so they team up with a real estate syndication as a passive investor and can achieve strong equity multiples over time.

Index funds, crowdfunding sites, mutual funds, self-investment management websites and simply owning precious metals are good ways to invest smaller amounts of capital. Being diversified over multiple asset classes is key for any investor whether they are getting started or already accredited.

Investment Experience

Accredited investors are considered wealthy enough to take risks with larger amounts of capital and the SEC expects them to have more investment experience, although in reality, this is not always the case. A savvy investor could not yet be accredited but a high earner who has amassed wealth through high pay per hour may be considered accredited although have limited investment experience.

Where Can Non-Accredited Investors Invest?

Luckily, today’s marketplace offers incredible opportunities for people just getting started investing who are not yet accredited and accredited investors alike. Of course, every opportunity must be vetted and fit into your personal investment goals.

Advancements in technology allow anyone with just a few hundred dollars to purchase their own stocks, bonds, passive ownership of the real estate, cryptocurrency, even precious metals, usually through an app on their phone. It’s never been easier to invest passively but that also leaves room for error. Many new investors are finding success and failure learning the hard way that day trading often ends in losses. Long term investment goals implemented over time return the best results.

The Securities and Exchange Commission

The Securities and Exchange Commission (SEC) determines the accredited investor definition and regulates accredited investments such as hedge funds, venture capital, private equity funds, mutual funds, and other funds within the stock market. Investment opportunities for accredited investors can also include private placements for real estate investments.

Opportunities for accredited investors are not necessarily reviewed by the Securities and Exchange Commission and one’s net worth is often self-verified. The SEC plays the role of setting the rules and, when necessary, enforcing them but they do not review and approve most investment opportunities for accredited investors.

The reason the SEC exists is to protect investors. A more complete accredited investor definition can be found on their website.

Real Estate Syndication

A real estate syndication is when funds are pooled to purchase a larger property, generally commercial real estate. This is regulated by the securities and exchange commission but is not necessarily limited to accredited investors. Certain investment opportunities can be open to “Sophisticated Investors” as well.

What is a “Sophisticated Investor”?

A sophisticated Investor is an individual with sufficient capital, experience and net worth to engage in more advanced types of investment opportunities. The investment company you are working with or your investment advisors can help determine your accredited investor status.

If you don’t qualify as an accredited investor, a private fund may still be able to accept your investment if you are a sophisticated investor. Your joint net worth with your partner or experience completing real estate deals can help you qualify to participate in professionally managed funds.

Based on the JOBS act in 2016, an investment vehicle can be created using Regulation D 506(b) which would allow for up to 35 non-accredited investors, as long as they fall into the category of “Sophisticated Investor”.A hedge fund will normally not be structured to accept anyone who is not an accredited investor.

Real Estate Crowdfunding

Real Estate Crowdfunding is completed via online investment platforms and is a somewhat recent advancement in the real estate market. No longer are private real estate investments limited to accredited investors and hedge funds. Today anyone can make a small investment in real estate through a number of websites or even an app on their phone.The investor is responsible for all due diligence so even if you don’t hold accredited investor status, you are still expected to understand the investment and complete due diligence.

REITs

REITs stand for Real Estate Investment Trusts and is a stock backed by real estate property. This is a good option to create passive income but public traded REITs especially are subject to the volatility of the stock market.

Private companies can also create a REIT that would often be limited to accredited investors. Shares in a REIT could be a nice addition to your investment portfolio as this investment vehicle tends to produce strong dividends based on rental income.

Individual investors may find a REIT does not offer tax depreciation where direct ownership of real estate does.

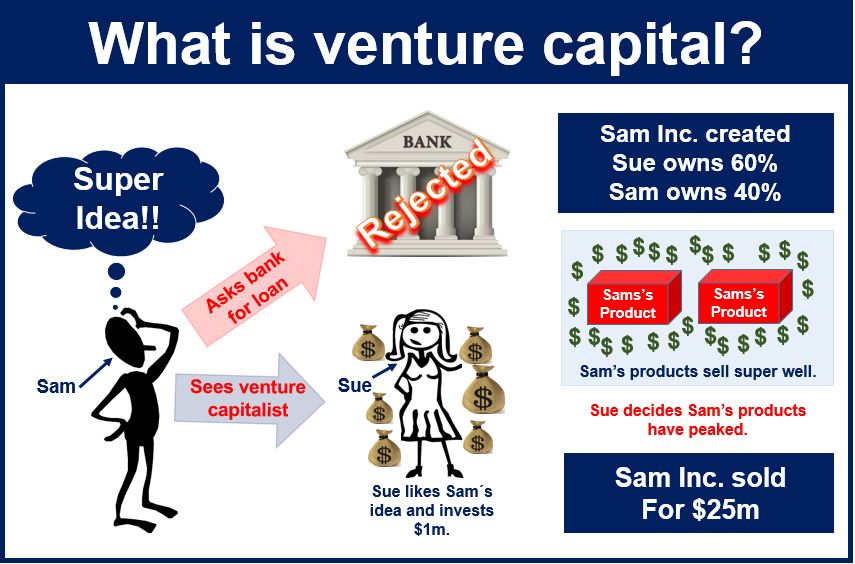

Venture Capital

Venture Capitalist investment strategies tend to be to invest in established companies that are prime for growth. Angel investors prefer to invest in a company at the seed stage where venture capitalists will seek a more established investment opportunity.

Accredited investors can find unique investment opportunities through a hedge fund seeking to place venture capital. Hedge funds and other investment funds may team up with financial advisors to help accredited investors make investment decisions.

There is often a large minimum investment when it comes to venture capital. However, this financial sector has been known to produce a nice equity multiple for qualified investors and can generate passive income.

Private Equity Funds

Private Equities can be an excellent option for accredited investors to generate passive income and build their net worth. These funds often invest in professionally managed real estate. Commercial real estate offers unique tax benefits and real estate is a tried and true alternative investment.

Private equity real estate is normally limited to accredited investors but non-accredited investors can sometimes participate as “Sophisticate Investors”. The private fund will explain if they can accept non-accredited investors. A larger investment will be required than you would find on a crowdfunding website.

Hedge Funds may participate in these investment opportunities along with other accredited investors. One’s net worth can grow exponentially if invested in an area where property values grow as seen over the last decade in the high demand housing market throughout the US.

FAQs

Do accredited investors get higher returns?

Accredited investors have access to exclusive investment opportunities so with the right strategy accredited investors earn higher returns.

However, it depends on the investment vehicle and your goals. Even hedge funds lose money sometimes so just because you are an accredited investor does not guarantee you will earn a high return.

What’s the best investment strategy?

A general rule of thumb for making large returns is invest for the long run, not for short term gains. Most investors that partake in day trading or highly speculative trades end of netting a lose. The best strategy is to have a 1, 5, 10 and 20 year investment plan that is formulated from proven strategies.

Is being an accredited investor worth it?

Accredited investors access more alternative investments but like most investors, they need to make their own investment decision. Your financial portfolio is ever-changing so when making your own investment decisions it may be best to speak with a financial professional when reviewing potential investments.

What benefits do accredited investors get?

Accredited investors can achieve a more diversified portfolio. Traditional investment options are more limiting although these days there are plenty of options for accredited and non-accredited investors.

Even if you are not yet an accredited investor, you can become an accredited investor by making sure 10% of your income is used as investment funds. By “paying yourself first” and investing in an asset class that is not your primary residence you will in time become an accredited investor.

How much do accredited investors make?

An accredited investor would expect to earn about a 10% to 20% annualized return on their investment. A hedge fund generally seeks to earn a return of over 20% per year.

Returns are of course not guaranteed, even the most experienced investors lose money at times. Just because you are an accredited investor does not guarantee you will have a winning investment portfolio.

How do I Become an Accredited Investor?

The key to becoming an accredited investor, or millionaire, through passive investing is maintaining a proven long term strategy. Don’t panic when market drops, buy low and sell high. Diversify some capital out of the stock market and into professionally managed assets.

Being a high earner will accelerate your pathway to accredited status but investing 10%+ of your income religiously and sticking to a winning strategy will, in time, allow you to build financial freedom and become an accredited investor.

What is a Well Diversified Investor?

Diversification is not putting your entire investment into one asset class but also implementing a conscious strategy to protect your capital while growing it. Be sure to have some passive ownership in commercial properties to take advantage of the tax benefits of real estate. Convertible investments, interval funds, hedge funds, real estate, mutual funds and cryptocurrency may make up today’s successful investor portfolio.

Ensuring your net worth is not too heavily reliant on one central marketplace is important as well.

What qualifies as income for an accredited investor?

To become an accredited investor you may need to show certain financial statements to prove your net worth. An accredited investor may need to show sufficient personal capital as well.

Income from business activities, passive investments and W-2 income all qualify. Proof of net worth may be requested via a bank statement, portfolio summary, a letter from your financial advisor or banker.

Buy the Mansion Last

Your primary residence cannot be included in the valuation when determining if you are an accredited investor. The fastest way to become accredited is to not spend your capital on a big house but to instead invest in cash flow producing assets.

Research has shown that people who exhibit self-control with their free capital and use it to own income-producing assets become millionaires over time even if their W-2 income is average. Saving and investing wisely leads to wealth faster than earning and spending. Many people who earn a high W-2 income fall into the “rat race” meaning they build a lifestyle that costs what they earn and now they must work more hours just to pay the bills.

Pay Less Taxes

True wealth is created by not earning and spending but earning and investing with tax shelters in mind. Being a high earner is important but what’s more important is what you keep. A w-2 income is the highest taxed form of income, the government takes up to half of your income before it even hits your account.

Owning assets like income-producing real estate can not only build wealth and cash flow over time but allow you to pay fewer taxes. Be sure to invest with professionals to get the best results in any asset class.